THE STATE OF THE EUROPEAN UNION

82

treated with caution. A lower share can also

stem from lower social needs (lower unemploy-

ment or a more convenient demographical

structure of the population). In this sense, the

social protection ratio, that is, the share of social

expenditure in the GDP, strongly increased in

the huge 2009 recession to subsequently de-

scend again (cf.

Table 6

).

Within the Member States, inequality has

grown mainly in the last twenty years. It could

most clearly be observed in the new Member

States: they had equitable income distributions

before the political change which became clear-

ly unequal during their transformation towards

the market economy. Nevertheless, the societies

of some CEE countries are still the least une-

qual. Some countries were able to slow down

this process and slightly reverse it. Still, inequal-

ity is even higher if we take market income into

consideration, since the tax system and the wel-

fare state redistribute income so that inequality

of disposable income stays much lower. The

most important redistribution mechanism is the

pension system, which causes the size of redis-

tribution to stay lower in countries with funded

pensions (i.e. the Netherlands) (where pensions

are regarded as market income).

Market income inequality rises mainly

through globalisation, technological progress

and the weakening of trade unions. Both a de-

creasing wage share and a higher wage gap

(strongly and disproportionally increasing in-

comes for top managers and bankers) intensify

inequality. The growing importance of wealth

(in relation with the GDP) and its increasing con-

centration are other important causes (Piketty

2013). The increasing inequality of the dispos-

able income is caused by the ‘reforms’ in the tax

system and the welfare state. Top tax rates and

the taxation of wealth and inheritance were

lowered in many countries, while pensions and

other transfer incomes were reduced or not

adapted to the development of prices and in-

come.

The development of Europe-wide inequality

The to-date existing inequality data doesn’t say

much about the EU as a whole, because the

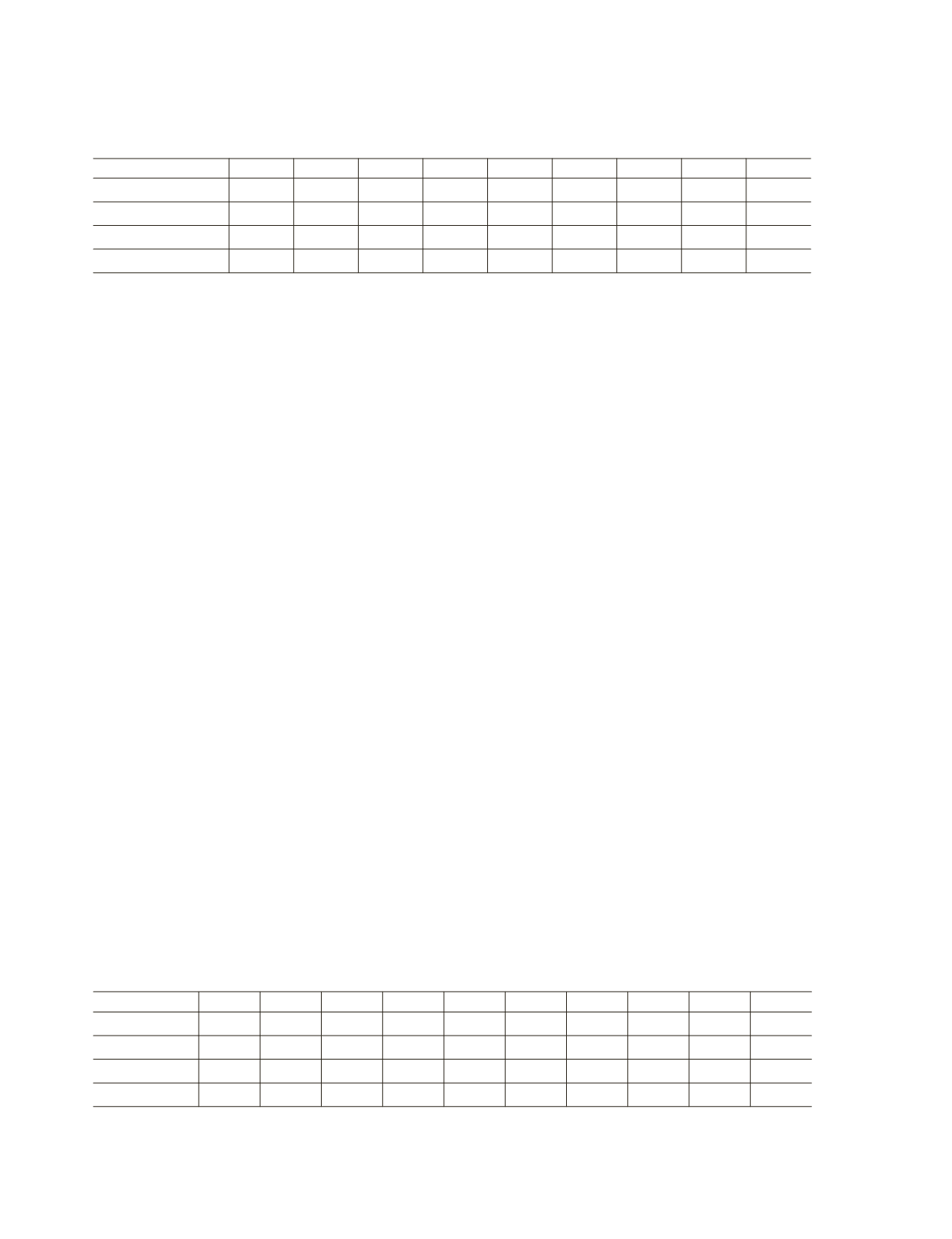

Table 6.

Development of the social protection ratio 2000-2011

2000

2002

2004

2006

2007

2008

2009

2010

2011

Standard deviation

5

.

5

5

.

8

6

.

1

6

.

0

5

.

9

5

.

6

5

.

7

5

.

6

6

.

0

Minimun

13

.

0

12

.

7

12

.

8

12

.

1

11

.

3

12

.

7

16

.

9

17

.

6

15

.

1

Maximun

29

.

9

31

.

3

31

.

6

31

.

2

30

.

9

31

.

3

34

.

7

34

.

3

34

.

2

Max/min

2

.

3

2

.

5

2

.

5

2

.

6

2

.

7

2

.

5

2

.

1

1

.

9

2

.

3

Source:

Eurostat and author’s calculations.

Table 7.

Development of the poverty rate 2005-2014

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Maximun

46.3

61.3

60.7

44.8

46.2

49.2

49.1

49.3

48

40,2

Minimun

9.6

12.3

12.1

8.7

9.0

9.4

9.3

9.3

9.0

7,4

Max/min

4.8

5.0

5.0

5.2

5.2

5.2

5.3

5.3

5.3

5,4

Standard deviation 8.8

10.3

10.2

7.8

8.1

8.3

8.3

8.4

8.1

7,0

Source:

Eurostat and author’s calculations.