MONETARY POLICY AND THE PRODUCTIVE ECONOMY IN THE EUROZONE

53

issue lies in the question mark hanging over the

effectiveness of the monetary expansion. In

other words, the extent to which, with stricter

management, similar results could have been

achieved with a substantially lower monetary

effort, or whether –the other way round– sub-

stantially better results could have been achieved

with the same monetary expansion effort.

As we can see, the virtual absence of oversight

and responsibility over the contributions of

resources to the banking system makes it impossi-

ble to accurately quantify what is going on. Yet

there certainly are sufficient data to demonstrate

the enormousness of the diversion of resources that

the monetary expansion as a whole represents.

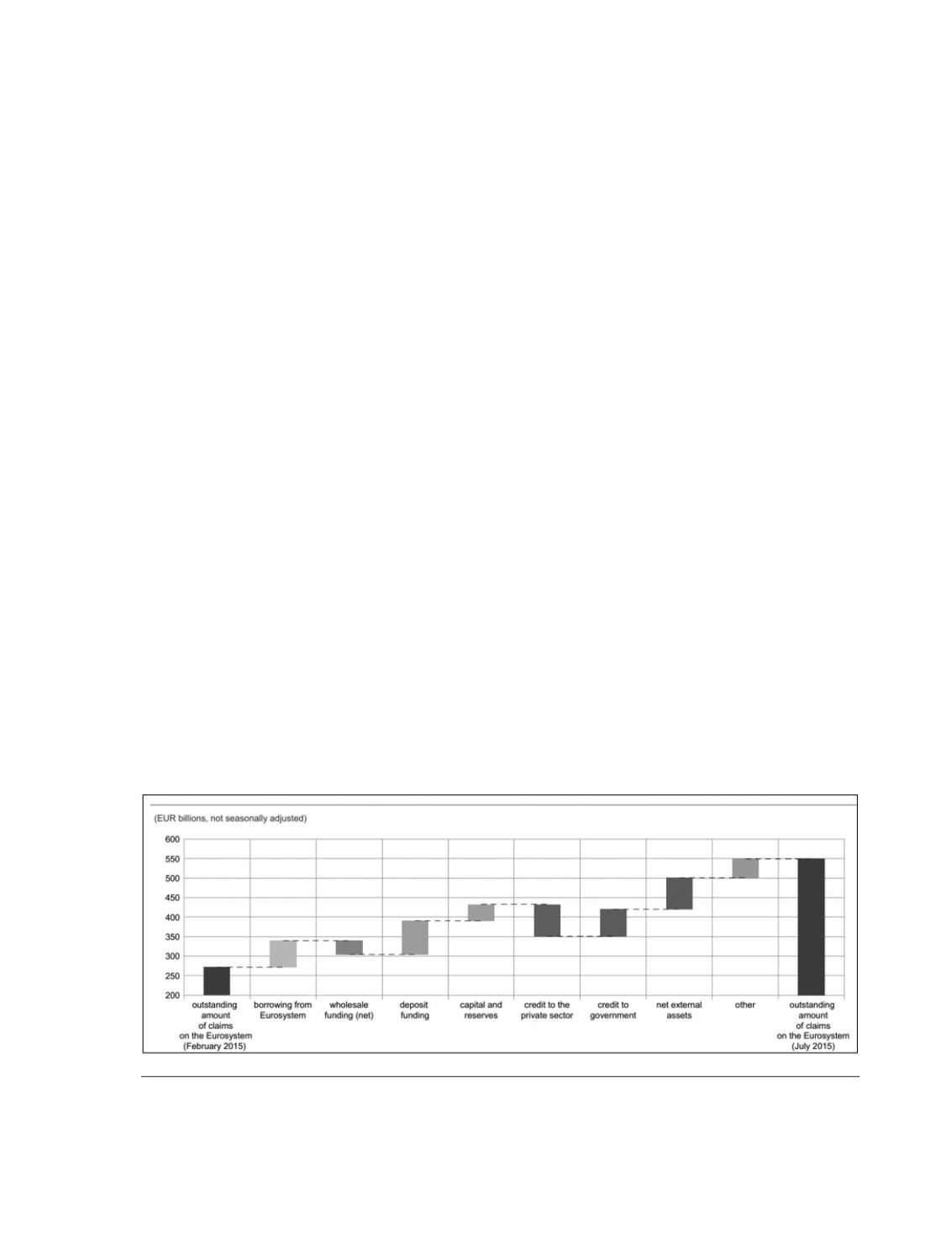

We will provide some data concerning the

TLTRO programmes later. Meanwhile, let us look

at, for example, the ECB’s own calculations on

the use of the Asset Purchase Programme funds,

based on the analysis of the banks’ balance

sheet movements (

Chart 7

).

As we can see, if converting these data into

quantified conclusions is complex, it does seem

clear that the transfer of these resources to

lending is only partial and minor.

The information repeatedly provided by the

aforementioned quarterly survey conducted by

the ECB among the European banks that tap its

resources leads us to the same conclusion. In

response to the question on the use made of

the funds received, only 30 % of the banks ac-

knowledged that the money tapped “has con-

tributed considerably” or “has contributed

somewhat” to boosting lending (

Chart 8

).

These data reveal, on the one hand, the visi-

bility with which it is conveyed that the resources

received from the Eurosystem are not allocated

to monetary policy purposes. On the other, they

also demonstrate the huge scale of this diversion

of resources in relation to the Eurozone’s mon-

etary policy as a whole and, of course, in relation

to the European economy as a whole.

The significance of the TLTRO programme

From the point of view of our report, the TLTRO

programme, based on “targeted” long-term

quantitative easing operations, holds particular

interest.

Chart 7.

Balance sheet movements of MFls other than the Eurosystem that correspond to the change in reserve

holdings between end-February and end-July 2015

Source:

ECB.