THE STATE OF THE EUROPEAN UNION

56

ure from the point of view of its targeting to-

wards bank lending.

However, the conceptual importance of this

programme is very high. Through it the

European Central Bank is acknowledging that

laying down conditions to ensure the link with

the real economy is not inconsistent with

Eurozone monetary policy – and nor is establish-

ing reporting requirements for the banks that

tap the resources, as is done in Article 8 and in

Annex II of the ECB Agreement of 29 July 2014

that implemented the TLTRO Programme.

It seems clear that from this precedent the

question that immediately arises is why the rest

of the monetary expansion programmes are

not regulated as “targeted”. And why similar

reporting requirements are not laid down in

them.

Monetary policy and growth policy

The relationship between monetary policy and

economic growth tends to be focused from the

standpoint of the traditional dispute between

those who champion more expansionary poli-

cies and those who advocate restrictive policies.

The latter tend to argue that monetary policy

cannot be an instrument to boost growth. It is

not the aim of this document to enter into that

dialectic. Our standpoint has no bearing on

whether monetary policy should “be used” as

an instrument for economic expansion in gen-

eral or not. What we are interested in highlight-

ing in this report is how, from another stand-

point, economic growth is inseparable from

monetary policy.

While it may seem obvious, price stability is

not just the result of money supply develop-

ments, but also of developments in the demand

for money. While monetary policy tends to fo-

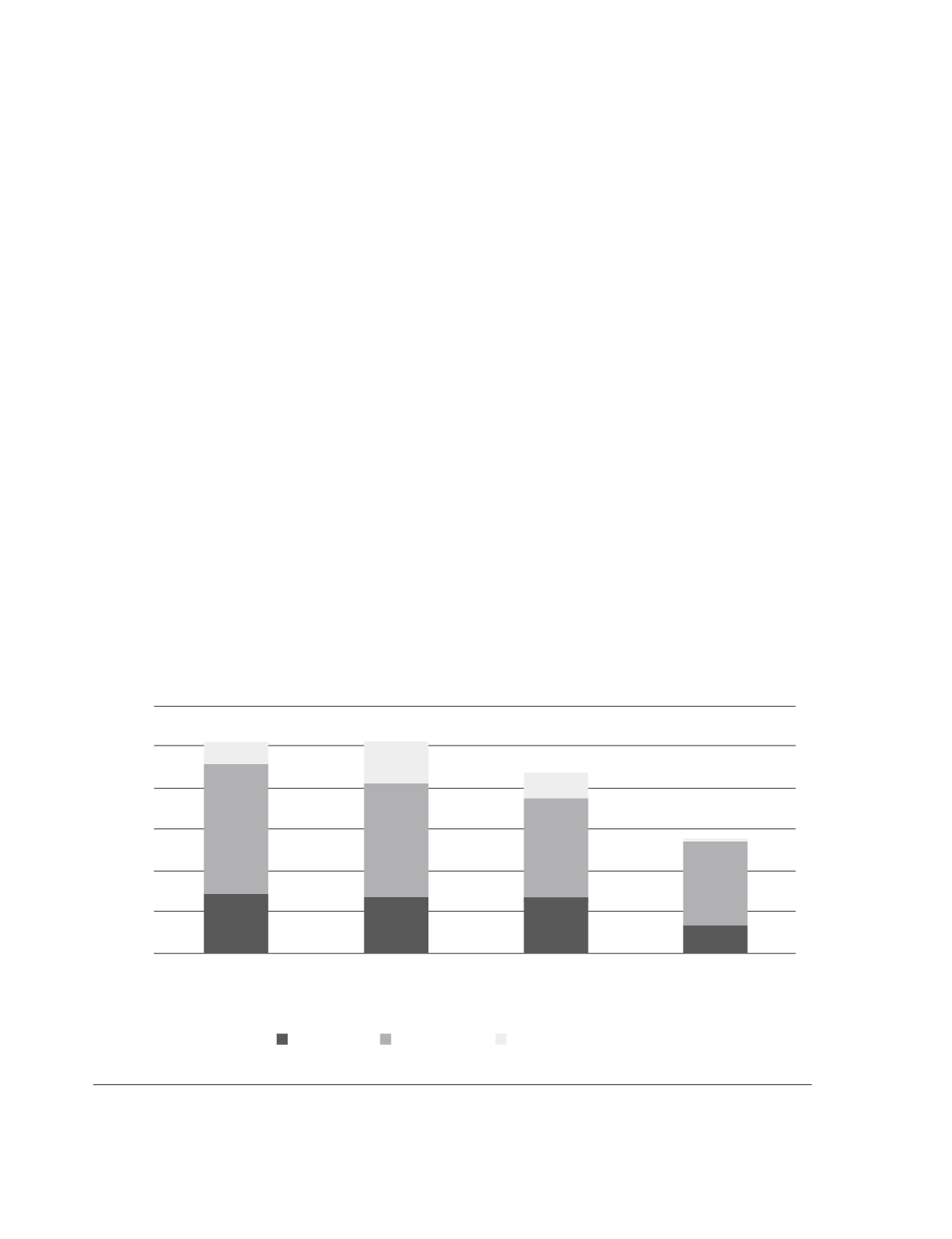

Chart 10.

Use of funds from the past and future TL TROs

Source:

ECB.

120

100

80

60

40

20

0

Refinancing

Jan 15 round

Jan 16 round

Future TLTROs

Jul 15 round past

TLTROs

Granting loans

Purchasing assets

11

64

28

20

59

25

12

51

41

14

25