MONETARY POLICY AND THE PRODUCTIVE ECONOMY IN THE EUROZONE

55

However, the results of this apparent target-

ing effort are more than limited.

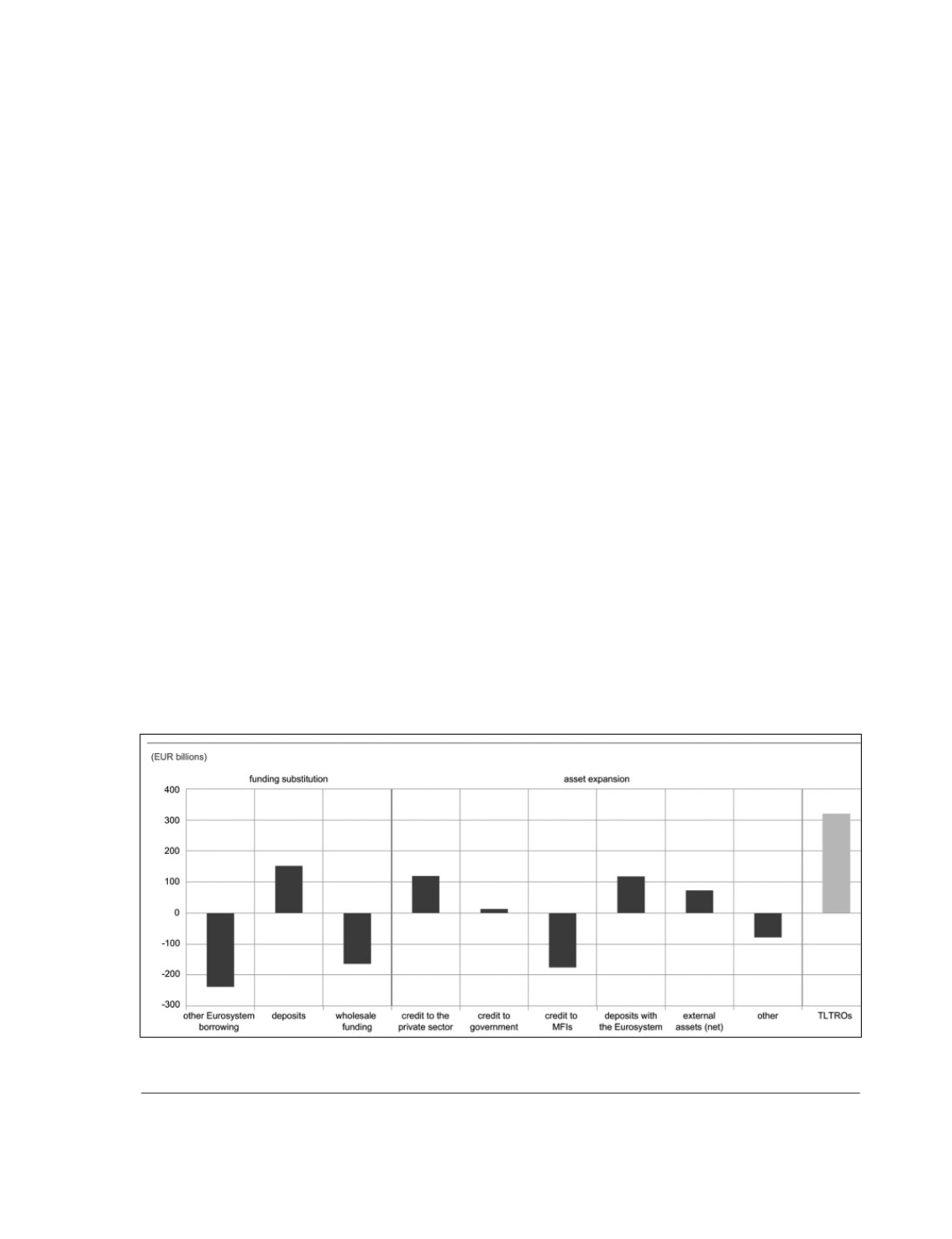

Let us see, firstly, the results of the analysis

that the ECB itself conducted in July 2015,

based on the changes reported on the balance

sheets of the banks receiving funds from the

TLTRO Programme (

Chart 9

).

As we can see, it seems clear that in the case

of the TLTRO too, the success in the allocation

of these funds to bank lending is very limited.

Surprisingly, despite the objectives explicitly

defined by the Programme, the banks receiving

funds are apparently quite unashamed when it

comes to declaring that they have not allocated

the funds received to boosting lending, but to

other purposes (

Chart 10

). This is also demon-

strated by the aforementioned

“Euro area bank

lending survey”

, the periodical survey of the

Eurozone’s main banks.

As we can gather from the chart, even in this

“targeted” programme the group of banks that

replied that the resources tapped contribute ei-

ther “considerably” or “somewhat” account for

only 41 % to 64 % of the total recipient banks.

The question is how it is possible that around

half of the banks can say that these resources

have not contributed at all to an increase in

lending.

The answer lies in the fact that the “target-

ing” that the programme appears to boast is

only limited:

– The banks can finance themselves through

the programme for two years without fulfill-

ing any requirement about the purpose of

the funds.

– Only the banks that want to keep the funds

beyond 29/09/2016 are obliged to observe

the “targeting” requirements.

– ��� �������������� ����� ��� ���� ���������� ����

In approximately half of the resources pro-

vided so far –200 billion euros out of a total

of 400 billion– the only requirement lies in

increasing the balance of net lending, with-

out demanding a specific amount of in-

crease.

This being the case, it is hardly surprising

that the TLTRO Programme has been a fresh fail-

Chart 9.

Changes in the balance sheets of banks participating in the TLTROs

Source:

ECB.