THE STATE OF THE EUROPEAN UNION

50

Need for a new approach

Structural inefficiency of monetary policy

In order to understand what is happening to

European monetary policy it is important to take

into account that the fundamental instruments of

monetary expansion are nothing other than sub-

sidies. It is aid handed over massively and system-

atically to the banking system, be it the shape of

granting loans or via especially low interest rates

when providing them. There is no reason why the

fact that these instruments are aid or subsidies

should be negative in itself. Public aid makes

sense when it has a proportionate or significant

favourable impact on the general interest.

Similarly, this massive and systematic assis-

tance for the banking sector through monetary

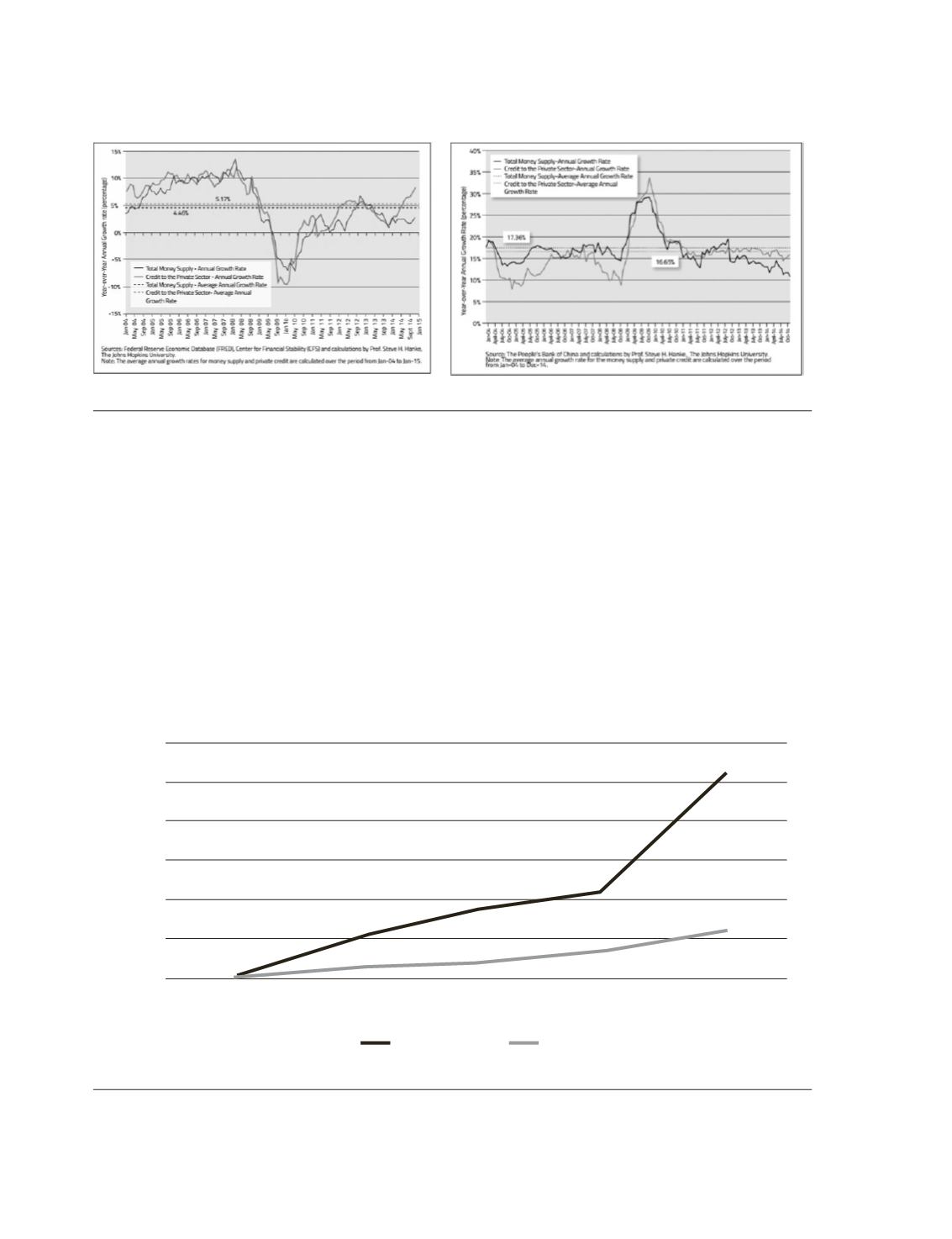

Chart 4. A)

United States money supply (M4) and private credit.

B)

China money supply (M2) and private credit

A)

B)

Chart 5.

Eurozone: monetary base and M3 2007-2015

Source:

ECB.

220

200

180

160

140

120

100

100

2007

2009

2011

2013

2015

106

108

114

125

120

134

144

205

Monetary base

M3