MONETARY POLICY AND THE PRODUCTIVE ECONOMY IN THE EUROZONE

51

expansion instruments is only justified insofar as

it has a clear public interest purpose –public in-

terest that, in this case, and according to the

Treaty of the European Union, is defined as price

stability through the boosting or contraction of

bank credit.

Logically, the public assistance or subsidies

are always handed over on condition that they

are allocated to the general or public interest

purpose for which the assistance has been es-

tablished. However, the major problem –and

the major question mark– of our current mon-

etary policy lies in the fact that the assistance

delivered to the banking system via the afore-

mentioned instruments is delivered –save for a

few exceptions– without any type of condition-

ality, without even requiring that they actually

be allocated to the purpose for which monetary

policy as a whole has been shaped.

As a result, it is certainly striking that the

banking system is entirely free to allocate the aid

received through loans and discount interest

rates to the uses and purposes that it sees fit,

whether they have any relation with the goals of

monetary policy or not –something truly unthink-

able in any subsidy or public aid programme. The

banks that receive resources from the Eurosystem

are free to allocate those resources to the ends

that they deem appropriate according to their

own interests, even using them to refinance

themselves, with no requirement to provide any

explanation whatsoever on the matter.

In practice, this situation has meant that a

substantial part of the potential impact of the

assistance and subsidies channelled into the

banking sector through monetary expansion

has been lost, for having been allocated to dif-

ferent purposes to those supposedly intended

to have an influence on the Eurozone money

supply.

Interest rate policy and quantitative easing

are put into effect by delivering resources to the

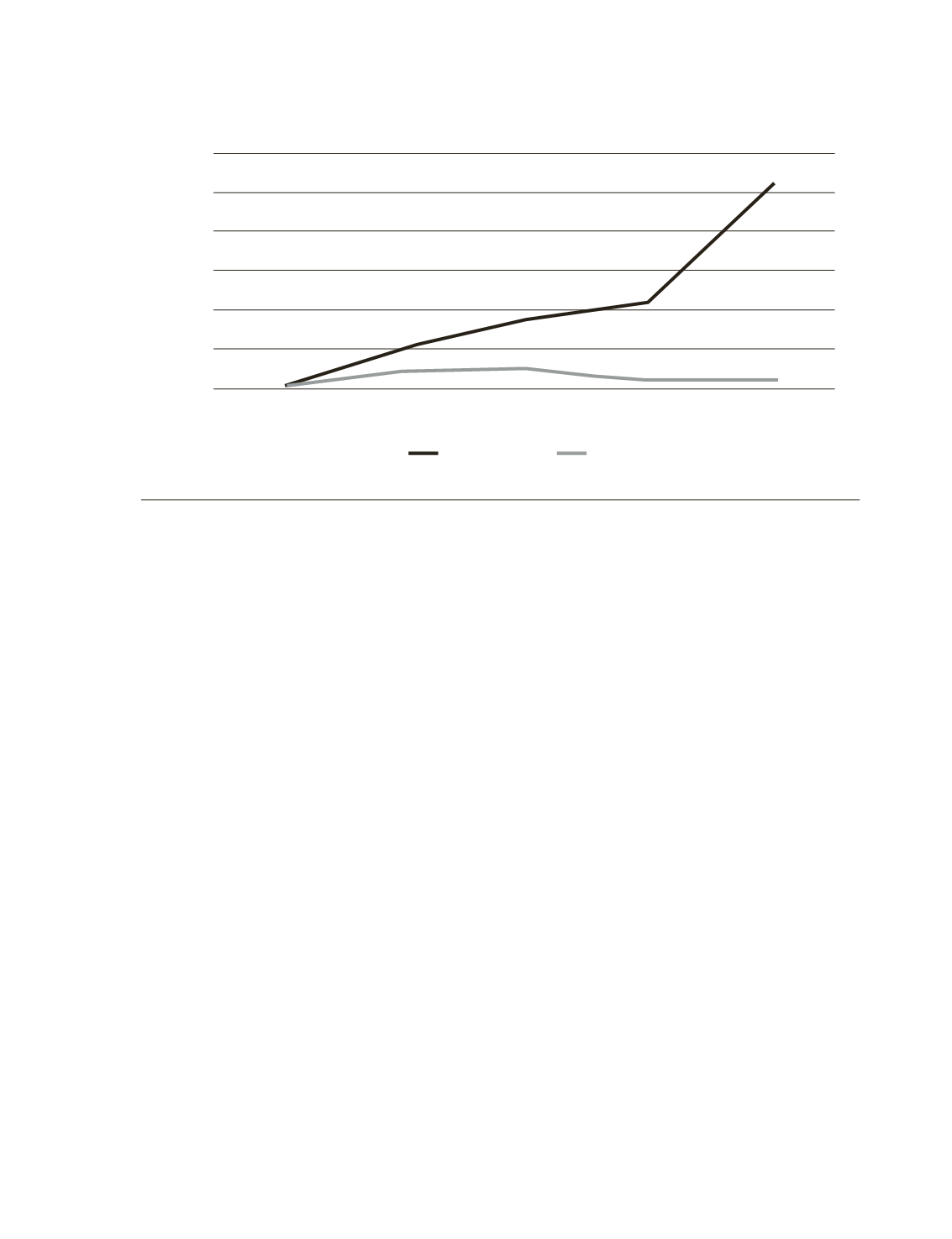

Chart 6.

Eurozone: monetary base and private credits 2007-2015

Source:

ECB.

220

200

180

160

140

120

100

100

2007

2009

2011

2013

2015

108

110

105

105

120

134

144

205

Monetary base

M3