THE STATE OF THE EUROPEAN UNION

44

expansion have nothing to do with one anoth-

er? Apparently, in both cases we are referring to

public resources channelled into the European

economy. If that is the case, the key question to

consider is why monetary expansion and invest-

ment policy are approached in such a different

way as to give us such striking figures as the

ones we see above.

This backdrop is certainly worth some atten-

tion, particularly because of the fact that neither

public authorities nor experts nor the media

have taken the trouble to explain why, in view

of the impressive amounts allocated to the

European economy through monetary policy,

investment policy is obsessed with raising com-

paratively tiny budgetary resources and, what’s

more, the political narrative of our institutions is

built around the supposedly extraordinary effort

we are making through the Juncker Plan, while

we forget what is happening to more than 2.8

trillion euros channelled into monetary policy.

The usual line of argument is apparently sim-

ple. It is based on taking it for granted that

monetary policy and investment policy have no

direct interrelation and, therefore, must be ana-

lysed in clearly different ways.

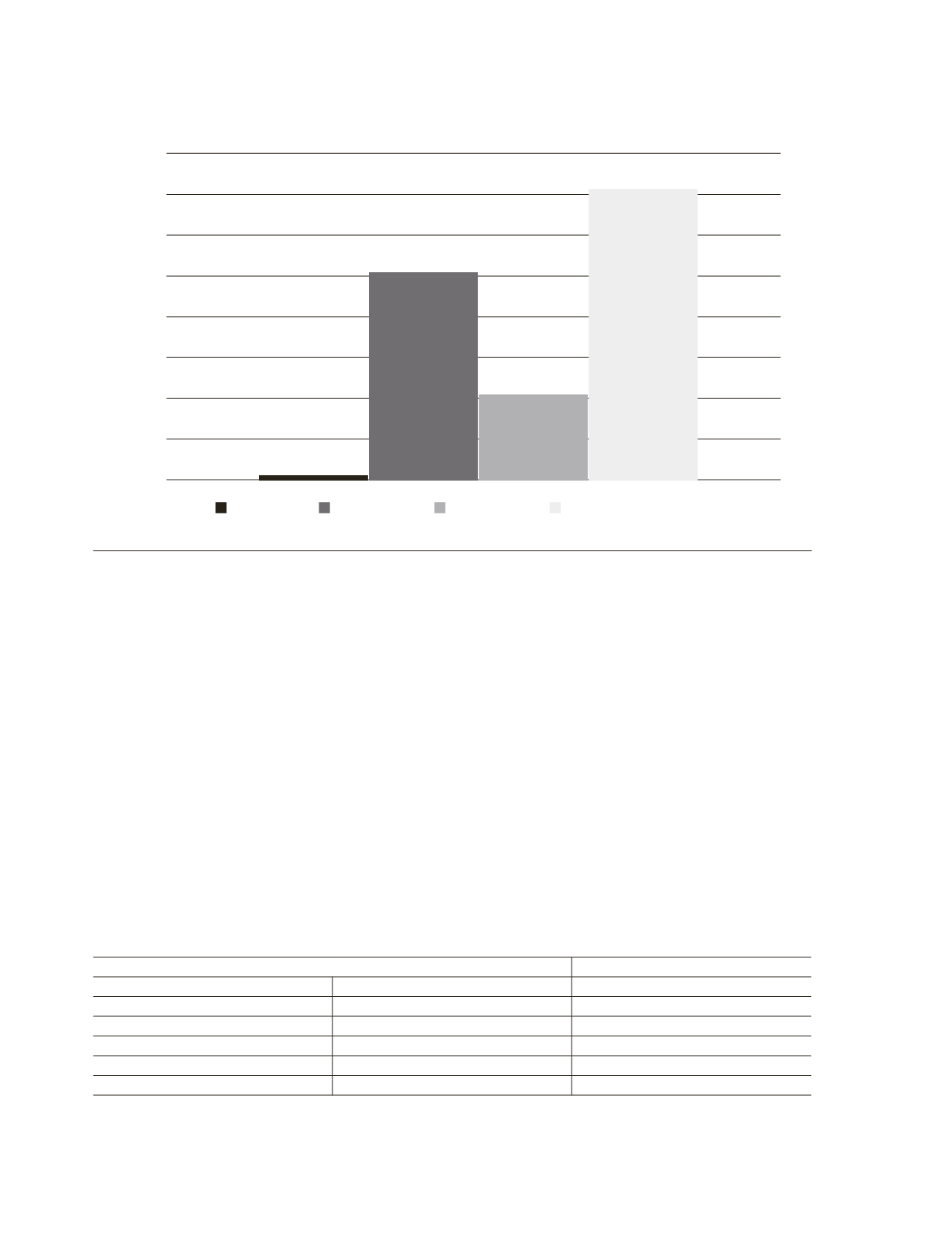

Chart 1.

Juncker Plan and long-term monetary expansion programmes (millions of euros)

1,600,000

1,400,000

1,200,000

1,000,000

800,000

600,000

400,000

200,000

21,000

1,018,500

1,424,588

417,300

0

Juncker Plan LTRO 2011-12 TLTRO 2014-16 APP programmes

Data to 31/01/2016.

Source:

European Commission/ECB/EKAI Center.

Table 1.

Eurozone’s GDP in 2014

Amount (

€

)

% GDP Eurozone 2014

Juncker Plan

21 billion

0.2 %

Monetary expansion programmes

2.860388 trillion

28.3 %

LTRO 2011-12

1.0185 trillion

TLTRO 2014-16

417.3 billion

APPs

1.424588 trillion

Source:

European Commission/ECB/EUROSTAT/EKAI Center