THE STATE OF THE EUROPEAN UNION

48

by the banking system and by others to be an

“increase in the speed of circulation of money”.

In any case, bank lending is the basic instrument

for transforming the monetary base into money

supply in the economy as a whole.

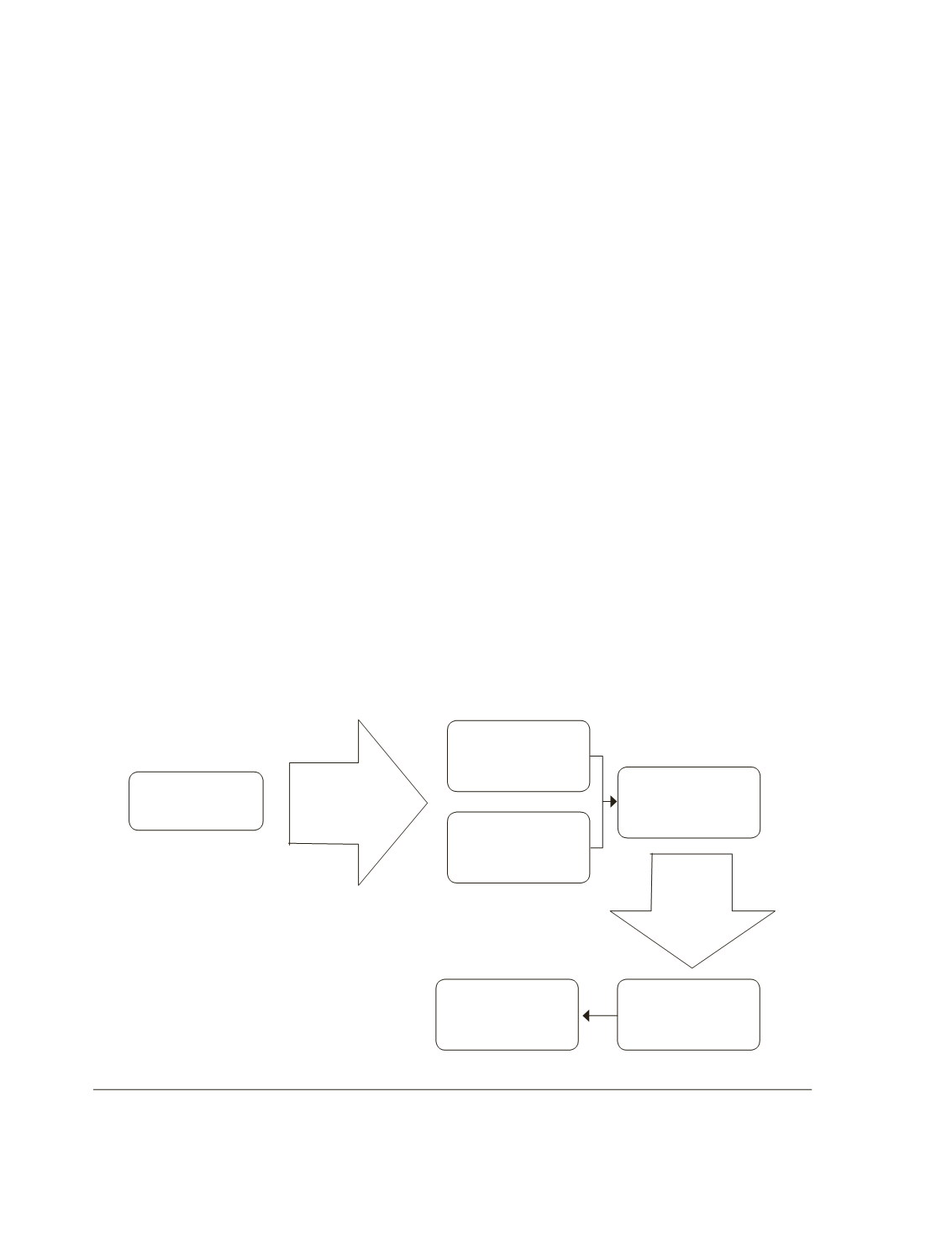

We can illustrate this monetary policy trans-

mission mechanism in

Chart 2

.

So it seems clear that the policy of “price

stability” implemented by the central banks ba-

sically operates through bank lending and,

therefore, it is also clear that bank lending is not

only not unconnected to monetary policy, it is

intrinsic in it.

Monetary base, credit and money supply

Economic reality demonstrates the direct rela-

tionship between bank credit and money supply,

the latter being, as we know, the basic objective

of the action of central banks in general and the

European Central Bank in particular, since, logi-

cally, price stability is directly linked to the bal-

ance between supply and demand for money.

As we can see from past data (

Chart 3

),

money supply in the Eurozone (M3) and bank

credit follow a clearly parallel development.

This parallel development of credit and mon-

ey supply is not connected to any specific char-

acteristic of monetary policy in the Eurozone.

We can see that equivalent effects also take

place in other types of economy as disparate as

those of the United States and China (

Chart 4

).

On the other hand, for the reasons that we

set out earlier, the relationship between the

monetary base (M0) and money supply (M3) is

only indirect (

Chart 5

).

And, for the same reasons, we can see how

the relationship between the monetary base and

private credit is also clearly indirect (

Chart 6

).

Indeed, what happened during this econom-

ic crisis clearly reveals that increasing the mon-

etary base is absolutely no guarantee of increas-

ing either credit or the money supply.

Eurosystem

↑

/

↓

monetary base

(M0)

↑

/

↓

base interest

rates

Banking sector

Price stability

↑

/

↓

money suppy

(M3)

Expansive/

contractive

policy

↑

/

↓

credit

Chart 2.

From Eurosystem to price stability

Source:

EKAI Center.