MONETARY POLICY AND THE PRODUCTIVE ECONOMY IN THE EUROZONE

49

This reasoning is also applicable to the man-

agement of interest rates by the European

Central Bank. There is no point in the ECB low-

ering or raising base rates if that does not affect

the banks’ activity as lenders and generate an

increase or reduction in bank credit as a result.

As we know, only this increase or reduction in

bank credit means, in turn, an equivalent in-

crease or reduction in the money supply.

As we can see, monetary policy is not only a

question of supplying or keeping financial re-

sources from the banking sector, or financing

the sector in more or less favourable conditions.

These actions are only intermediary instruments

devoted to a purpose. The true purpose of mon-

etary policy is, as we know, getting the banking

sector to increase or reduce the flow of credit to

the real economy in the right amount to effec-

tively influence money supply and, therefore,

price stability.

We are getting close, then, to the key ques-

tion we discuss in this report: the extent to

which monetary policy transmission mecha-

nisms are truly effective, from the decisions

taken by the Eurosystem to their impact on

bank credit.

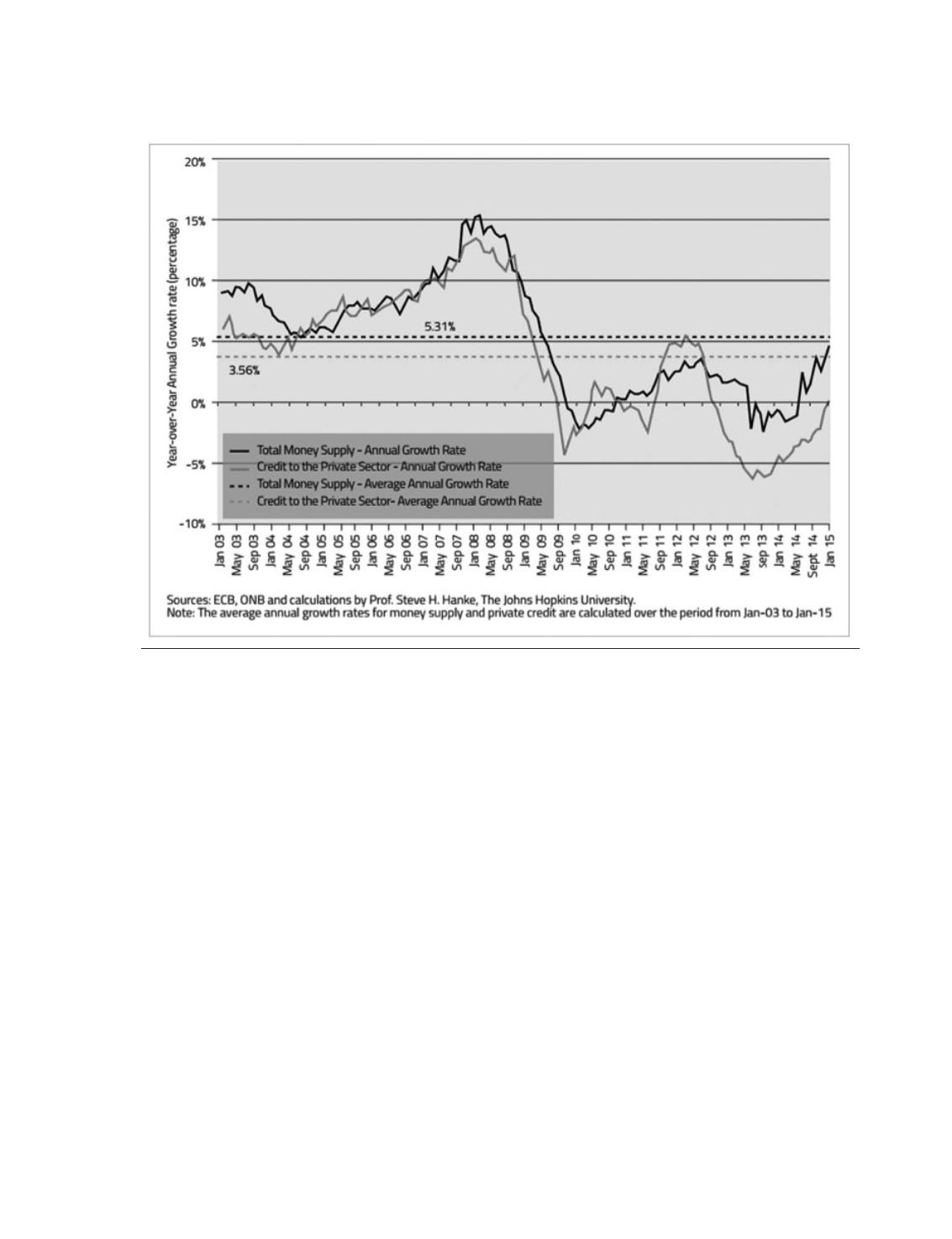

Chart 3.

Eurozone money supply (M3) and private credit