INEQUALITY IN EUROPE: UNEQUAL TRENDS

79

and 2014, as measured by the quintile share ra-

tio S80/S20, but this growth took place after

2008. In the countries with a positive develop-

ment (upper part of Table 4), there was an im-

provement until 2008, while those countries

whose inequality increased, went through it

especially after 2008 (with the exception of

Germany, whose inequality grew until 2008 due

to the “agenda” policy). Otherwise, the growth

phase until the crisis showed a decreasing ine-

quality in total, which tended to increase after-

wards.

The highest growth (by 1.3) appeared in

Spain and Germany; corresponding, in Germany,

to an increase of 34.2 %; in Spain, of 23.6 %

compared to the values in 2005 (Germany: from

3.8 to 5.1; Spain: from 5.5 to 6.8). If we meas-

ure the percentage growth since 2005, Germany

becomes the EU front runner, even if many

countries have a higher inequality level. The

strongest raises appear in the Scandinavian

countries as well as in the crisis countries Greece

and Cyprus (since 2008). Poland shows the

most successful reduction of inequality.

Table 4

presents a detailed overview.

Remark: no 2005 data available for the lat-

est accession countries Bulgaria, Romania and

Croatia.

All inequality values studied up to now refer

to disposable income, that is, after tax and

transfers (as household income normally con-

verted to equivalised income

6

). The inequality

amongst the “pure” market income is clearly

higher. Income distribution is affected by social

expenditure and the system of taxes and fees

which finances said expenditure. The following

Table 5

shows the income distribution based on

OECD data –measured with the Gini coeffi-

cient– before and after the redistribution due to

tax and transfers. Countries are arranged in as-

cending order according to their level of ine-

quality after the redistribution. The distribution

of the market income (before the redistribution)

is clearly more uneven than the distribution of

the disposable income (after the redistribution).

6

It implies an emphasis on the people in the household,

in order to calculate the effect on prosperity of shared flats

and expensive consumer goods like cars, fridges, washing

machines, etc.

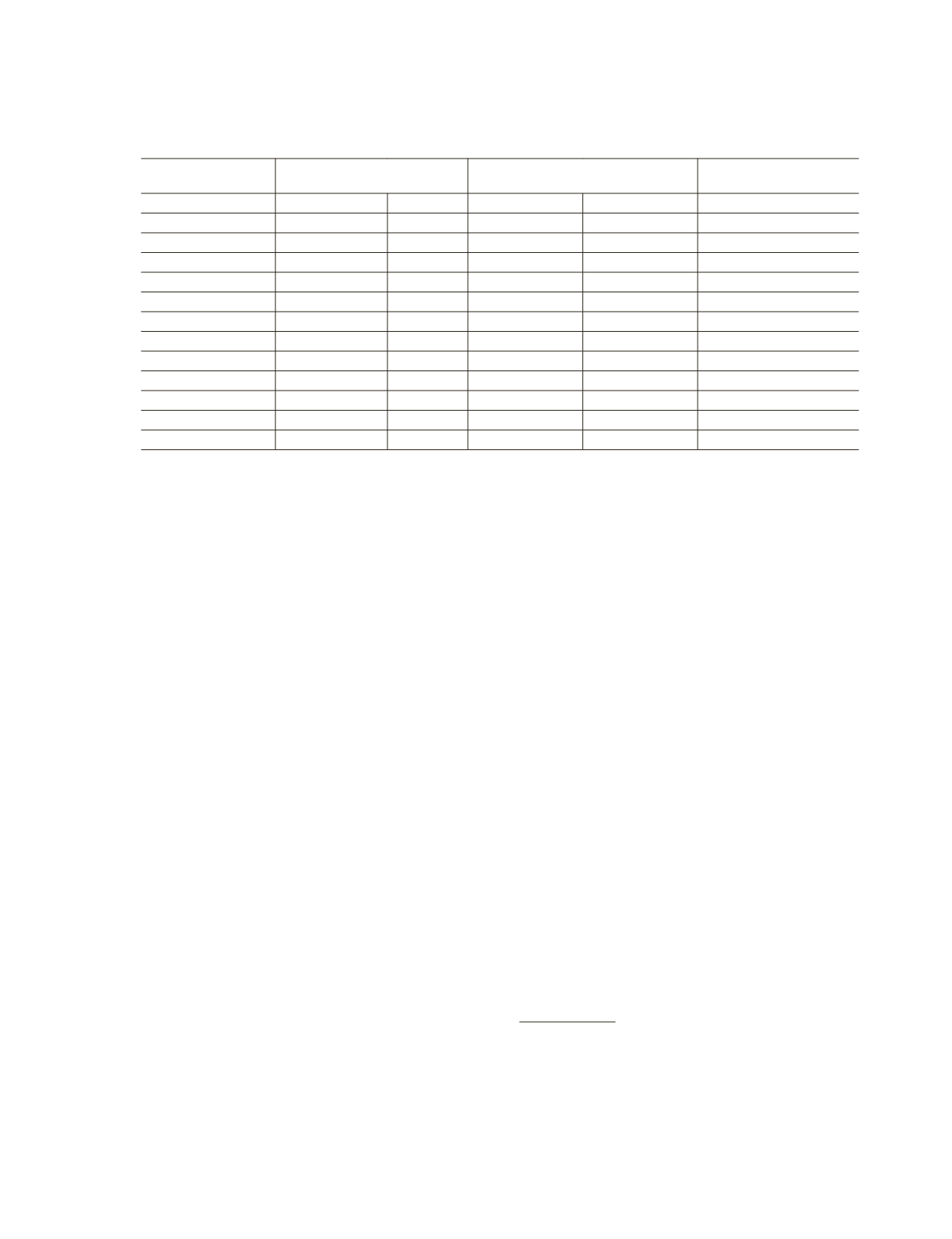

Table 3.

Development of the Gini coefficient in selected EU countries

Country

Gini in the base

year

Gini the latest available year

Change in %

Belgium

1983

0.257

2011

0.264

2.7

Denmark

1985

0.221

2012

0.251

13.6

Germany

1985

0.251

2012

0.291

15.9

Finland

1987

0.209

2013

0.262

25.4

France

1984

0.3

2012

0.306

2.0

Greece

1986

0.352

2012

0.338

-4.0

Italy

1984

0.291

2012

0.325

11.7

Luxemburg

1986

0.247

2012

0.299

21.1

Netherlands

1985

0.272

2013

0.278

2.2

Sweden

1983

0.198

2012

0.274

38.4

Czech Republic

1992

0.232

2012

0.251

8.2

Hungary

1991

0.273

2013

0.288

5.5

United Kingdom

1985

0.309

2011

0.344

11.3

Source:

OECD; author’s calculations.